Short Term Budgeting Continues to Reinforce Long term Policy Decisions

Chapter 3. Linking strategic planning to budgeting

Paraguay has developed interesting practices for ensuring alignment of annual budgets and capital expenditure with strategic policy objectives, such as the formulation of a national development plan with a long term planning horizon, reforming the budget structure and setting annual targets at the institutional level. Despite these improvements, the country faces challenges respecting the sustainability of such reforms and the need to complement these efforts with more developed performance-budgeting and robust medium-term budgeting frameworks.

Introduction

The budget is a central policy document of government, showing how annual and multi-annual objectives will be prioritised and achieved through resource allocation. Alongside other instruments of government policy – such as laws, regulation, strategy and joint action with other actors in society – the budget aims to turn plans and aspirations into reality. The budget is therefore a planning tool and a reflection of a government's priorities. It requires sound governance to make it efficient, strategic, clear, transparent, and trusted by citizens. The experience of recent years has underlined how budgeting is thus an essential keystone in the architecture of trust between states and their citizens.

The OECD Recommendation on Budgetary Governance (2015) states that budgets should be closely aligned with the medium-term strategic priorities of government, through organising and structuring budget allocations in a way that corresponds readily with national objectives and developing a stronger medium-term dimension in the budgeting process, beyond the traditional annual cycle (Box 3.1).Effective medium-term budgeting is a supportive measure toward creating a greater link between budgets, plans and policies –complementary to programme budgeting– and an integral part of providing predictability to policy-making. In this way, medium-term budgeting can serve as one vehicle for:

-

Providing greater assurance to policy planners about multi-year resource availability; and

-

Identifying the appropriate medium-term goals against which resources should be aligned.

Likewise, performance budgeting tools are key to enabling governments to assess periodically whether the policy objectives, for which spending was committed, are in fact being achieved. It is thus crucial to ensure that performance; evaluation and value for money are integral to the budget process and are clearly linked with government-wide strategic objectives (Box 3.2).

Improving the quality of public finance management as a means to optimise the achievement of strategic national development objectives is a key challenge in Paraguay, as it is in many countries. Paraguay has implemented several reforms in this field, most notably the formulation of a national development plan with a long-term planning horizon, reforming the budget structure, and setting annual targets at the institutional level. Despite these improvements, the government and civil society are concerned about the sustainability of such reforms, which could be bolstered with a robust medium term expenditure framework and performance budgeting tools. Furthermore, Paraguay could consider consolidating other inter-connected and mutually supportive elements of budgetary governance, such as inclusive, participative and realistic debate on budgetary choices, transparency, openness and accessibility of budget documents, citizen engagement, effective budget execution, fiscal risks and budgeting within fiscal objectives.

Box 3.1. OECD Budgetary Governance Principle 2

Closely align budgets with the medium-term strategic priorities of government, through:

-

Developing a stronger medium-term dimension in the budgeting process, beyond the traditional annual cycle;

-

Organising and structuring the budget allocations in a way that corresponds readily with national objectives;

-

Recognising the potential usefulness of a medium-term expenditure framework (MTEF) in setting a basis for the annual budget, in an effective manner which:

-

has real force in setting boundaries for the main categories of expenditure for each year of the medium-term horizon;

-

is fully aligned with the top-down budgetary constraints agreed by government;

-

is grounded upon realistic forecasts for baseline expenditure (i.e. using existing policies), including a clear outline of key assumptions used;

-

shows the correspondence with expenditure objectives and deliverables from national strategic plans; and

-

includes sufficient institutional incentives and flexibility to ensure that expenditure boundaries are respected.

-

-

Nurturing a close working relationship between the Central Budget Authority (CBA) and the other institutions at the centre of government (e.g. prime minister's office, cabinet office or planning ministry), given the inter-dependencies between the budget process and the achievement of government-wide policies;

-

Considering how to devise and implement regular processes for reviewing existing expenditure policies, including tax expenditures, in a manner that helps budgetary expectations to be set in line with government-wide developments.

This chapter analyses how strategic planning can best be linked to the national budget in order to guarantee that planning is accompanied by the necessary financial resources to reach the strategic goals identified in the plan. The chapter starts with a description of OECD best practices in aligning strategic planning and budgeting. Then, the chapter gives a general overview of the budget cycle in Paraguay, highlighting some of its particular dynamics and challenges. Based on this general framework, the chapter offers a closer examination of recent efforts to better align government strategic priorities with the budget. Finally, the chapter provides suggestions and recommendations for the future development and direction of these initiatives, taking into account OECD best practices. This includes the option of designing a rolling medium-term expenditure framework in a manner that would support the effective roll-out of programme budgeting, while also introducing a stronger performance budgeting framework.

Box 3.2. OECD Budgetary Governance Principle 8

Ensure that performance, evaluation and value for money are integral to the budget process, in particular through:

-

helping parliament and citizens to understand not just what is being spent, but what is being bought on behalf of citizens – i.e. what public services are actually being delivered, to what standards of quality and with what levels of efficiency;

-

routinely presenting performance information in a way which informs, and provides useful context for, the financial allocations in the budget report; noting that such information should clarify, and not obscure or impede, accountability and oversight;

-

using performance information, therefore, which is (i) limited to a small number of relevant indicators for each policy programme or area; (ii) clear and easily understood; (iii) allows for tracking of results against targets and for comparison with international and other benchmarks; (iv) makes clear the link with government-wide strategic objectives;

-

evaluating and reviewing expenditure programmes (including associated staffing resources as well as tax expenditures) in a manner that is objective, routine and regular, to inform resource allocation and re-prioritisation both within line ministries and across government as a whole;

-

ensuring the availability of high-quality (i.e. relevant, consistent, comprehensive and comparable) performance and evaluation information to facilitate an evidence-based review;

-

conducting routine and open ex ante evaluations of all substantive new policy proposals to assess coherence with national priorities, clarity of objectives, and anticipated costs and benefits;

-

taking stock, periodically, of overall expenditure (including tax expenditure) and reassessing its alignment with fiscal objectives and national priorities, taking account of the results of evaluations; noting that for such a comprehensive review to be effective, it must be responsive to the practical needs of government as a whole.

Linking strategic planning and budgeting in OECD countries

OECD countries have implemented different public finance management tools that contribute to the alignment of the budget with the strategic objectives of the government. Most OECD countries have a medium-term expenditure framework (MTEF) in place (Figure 3.1). A well-designed MTEF forces stakeholders to deal with the medium-term perspective of budgeting and budgetary policies rather than adopting an exclusively year-by-year approach. Furthermore, it provides greater assurance to policy planners about multi-year resource availability and helps aligning these resources with government's medium-term goals.

MTEFs typically cover a period of three to four years and aim to improve the quality and certainty of multi-annual fiscal planning by combining prescriptive yearly ceilings with descriptive forward estimates. 'Estimates' in this context are calculations of how expenditure, revenue and the aggregate fiscal position will turn out under certain assumptions. By their very nature, high-level fiscal ceilings are set in a medium-term context. Ceilings are targets or limits set by the government regarding aggregate or policy-area spending for each year of the multi-year frame of reference. The ceilings may be updated annually or fixed for a period. For the medium-term framework to operate effectively, estimates and ceilings need to be reconciled within the context of a forward-looking approach to budgetary planning and policy formulation.

Accordingly, a medium-term framework should state clearly the government's medium-term fiscal objectives in terms of high-level targets such as the level of aggregate revenue, expenditure, deficit/surplus and debt. It should also facilitate stakeholders in identifying the policy choices and trade-offs that will be necessary in light of the estimates of what would happen in the following 3-5 years based on unchanged policies.

Most OECD countries have also undertaken reforms to ensure that budget allocations are organised and structured in a way that corresponds readily with the strategic national objectives (Box 3.3). In particular, some countries have introduced programme budgeting, structuring the budget by reference to functional and/or strategic programmes (as distinct from traditional financial "line items", heads and subheads of expenditure) in order to facilitate a clearer focus on the outputs and impacts of public spending, and thus to promote closer linkages with the medium-term planning and developmental processes. The perceived advantages of the approach include enhanced monitoring of programme effectiveness, improved allocative efficiency, and greater transparency to stakeholders with respect to the use and impact of public funds.

Box 3.3. French programme budgeting system

In 2001, France enacted a new organic budget law including a well-defined programme structure, shifting budget classification from nature of expenses to public policy objectives. According to this new approach, the budget must be divided into missions, programmes and actions:

-

A mission covers a series of programmes designed to contribute to a specific public policy. A mission can involve a single ministry or several ministries. The Parliament cannot change or adjust the Missions. It has to accept the budget allocations proposed by the executive government and has power only to vary the allocation between programmes.

-

A programme covers a coherent set of activities of a single ministry targeted to a specific public policy objective. If more than one ministry participates in a large public policy, each of them should have a separate programme, covering its own responsibility in that matter, and ensuring coordination. Thus a programme corresponds to a centre of responsibility. Accordingly, for every programme, a programme director is appointed. All the resources from the State Budget should be allocated and spent within a programme. In a similar way, resources allocated by the Parliament to a particular programme cannot be spent by the ministers for another programme.

-

An action covers a set of operational means to implement the programme. The budget breaks down resources allocated to the actions of each programme; however, this break down is indicative and not committing. There is indeed a high degree of freedom for expenditure choices for ministers, in order to allow the programme to reach its forecasted performance. However, there is one exception to this increased freedom: appropriations for personnel are not indicative but binding, in an asymmetrical way: personnel appropriations can be used for other purposes, but appropriations for other purposes cannot be used for personnel costs.

The Organic Budget Law prescribes an extensive performance reporting process to integrate performance information in the budget system through the following two types of mandatory budget documents: annual performance plans (projets annuels de performances, PAP) and annual performance reports (rapports annuels de performances, RAP). For a given mission, the PAP provides a detailed description of its purpose, goals, policy targets and performance indicators. As part of the annual budget act, the PAP documents are forward looking and are meant to contribute to the public debate about the costs and benefits of public policy. The RAPs are published in the first quarter along with the budget review act; they focus on performance achievements and provide detailed information on programme implementation and results. The RAPs are thus backward looking and tend to contribute to the public debate on the administration's performance.

Source: Loi organique relative aux lois de finances 2001

International experience suggests that programme budgeting should be implemented in a progressive manner, shifting from detailed financial "line-item" budgeting to programmatic and thematic budgeting, in an effort to promote greater engagement with the policy content and "meaning" of budget allocations. In many countries, programmes are selected within the context of a policy "cascade" from high-level strategic and developmental goals which inform medium-term, specific outcome goals, which in turn inform departmental or sectoral objectives and associated output targets and deliverables. Once programmes have been selected, countries can then move to allocate clear assignment of responsibility (organisational and, ideally, managerial) for the achievement of the selected programmes and targets.

A critical lesson from OECD countries in advancing a programme budgeting system has been the need to avoid information overload, and to secure the interest and buy-in of parliament, the public and indeed the government-wide system of public administration for the programme budget as the focal instrument of policy-making. International experience (Kraan, D. J., 2008) also found that there are two main success factors in undertaking a reclassification of the budget on the basis of programmes:

-

Budget estimates and multi-annual estimates should be well explained, preferably in terms of outputs and cost per unit; and

-

Strict rules of budgetary discipline should be put in place to guarantee that overspending on ministerial ceilings cannot occur.

A programmatic classification is recognised to be more appropriate for a policy-prioritisation function of the budget; it can also enhance the budget's managerial and macro-economic control functions. In order for the macro-economic control function to perform properly, budgeted programmes should not only contain estimates for the budget year but also estimates for the medium-term. In practice, multi-annual estimates may not be legally adopted and may have no binding status as "appropriations" but can be highly relevant for macro-budgetary planning.

Finally, these tools have also been accompanied by efforts to develop and use performance information to inform, influence and/or determine the level of public funds allocated towards those policies in the budgetary context. Among other purposes, performance budgeting can inform the budgetary decision-making process and enhance evidence-based policy-making. A performance budgeting system provides relevant information that facilitates the task of annual and multi-annual budgeting, including the core budgeting task of deciding on where limited resources are best allocated (or re-allocated). Likewise, a clear linking of budgets with results and impacts, drawing on findings from different sectors and from comparable countries and regions, helps to lay the basis for an evidence-based approach to policy-making

While the use of performance budgeting varies greatly, almost all OECD countries now use non-financial performance targets/measures in their budgeting budget process (Box 3.4). Even when countries have adopted similar models, they have taken diverse approaches to implementing these and they have adapted them to national capacities, cultures and priorities.

Box 3.4. International models of Performance Budgeting

Different models and approaches to performance budgeting are observed across the OECD. Even when countries have adopted similar models, they have taken diverse approaches to implementing these and they have adapted them to national capacities, cultures and priorities. In this context, the OECD has identified three broad categories of performance budgeting systems:

-

Presentational performance budgeting, which involves the provision of performance information in parallel with the annual budget, e.g. as a transparency exercise or for the background information of policy-makers, with no necessary expectation that the information will be taken into account in deciding upon the budget allocations;

-

Performance-informed budgeting, which presents performance information in a systematic manner alongside the financial allocations, in order to facilitate policy-makers in taking account of this information, to the extent that they may deem appropriate, when deciding upon with the budget allocations;

-

Direct performance budgeting (or performance-based budgeting), where performance information is provided with the financial information, and where there is the expectation that performance, relative to previously stated objectives, will have direct consequences for the budget allocations.

More recently the OECD has identified a fourth broad category:

-

Managerial performance budgeting, in which performance information is generated and used for internal managerial purposes and for organisational / managerial accountability, with a lesser focus upon the linkages with budget allocations.

Across OECD countries more generally, performance budgeting practices tend to fall into the first and second categories, with only a few in the third category (direct performance budgeting) for select types of expenditures (e.g. funding of higher education or hospitals).

Source: Ronnie Downes, Delphine Moretti and Scherie Nicol (2017)

The budget cycle in Paraguay

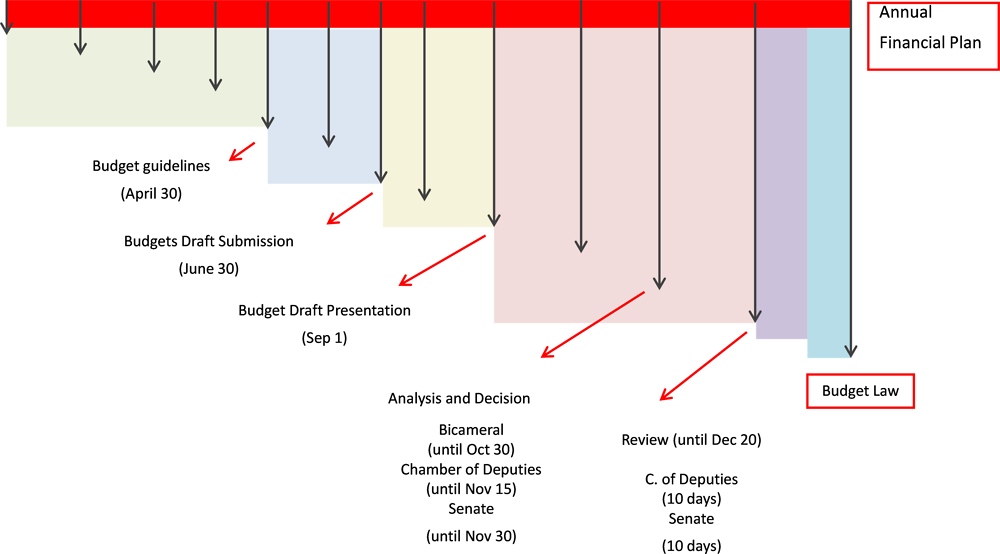

Paraguay has a budget calendar that is well specified and understood by the different stakeholders involved in the budget process. Budget formulation starts at the end of April when the budget guidelines are communicated to all agencies and entities of the State and finalised by the end of August, when the budget is submitted for discussion and approval. The budget Law is discussed for almost four months in the Congress and must be approved by December 20. The final version of the Law is then adapted by the Ministry of Finance in the Annual Financial Plan, where line ministers have the final budget allocations for the budget year (Figure 3.2).

As will be explained in further detail, Paraguay presents particular institutional settings that affect the credibility, transparency and sustainability of the budget document. In particular, the different roles and prerogatives of the Legislative and Executive Branches are not well-aligned; these tend to undermine the predictability and efficiency of budget allocations.

A rules-based, open and transparent budget process and Congressional approval should be the primary route for authorising and allocating revenues in a country. In contrast with standard practice in OECD countries, Paraguay's Annual Financial Plan prepared by the Ministry of Finance at the beginning of the year to adjust the expenditure ceilings approved in the Budged Law is the guiding document to programme expenditures.

Formulation

The Budget Directorate of the Ministry of Finance is responsible for the administration of the budget planning and programming process. The Technical Secretariat for Economic and Social Development Planning (STP) in the Presidency also supports the budget formulation and monitoring process. It coordinates the physical programming and supports public entities with the preparation of the draft budget and the alignment with the objectives of the National Development Plan.

The budget formulation starts at the end of April when the Ministry of Finance communicates the budget guidelines to all agencies and entities of the State (OEE). Based on these guidelines, the OEEs prepare their draft budgets and submit them for consolidation in the General Budget at the latest on June 30.There are some informal negotiations between the Ministry of Finance and line ministries during the budget consolidation process. Requests from line ministers are studied based on resource availability and their impact on the objectives of the National Development Plan (PND). There is no subcommittee within the institutional framework of Paraguay involved in the resolution of the budget negotiations. These negotiations fall within the sole competency of the Ministry of Finance. The consolidated budget bill must be presented to Congress by September 1st and must be approved (or rejected) by December 20.

Approval

Starting on September 1st, a joint bicameral commission composed of fifteen deputies and fifteen senators studies the budget for 60 days before issuing a non-binding recommendation. Then, the revised proposal moves to the Chamber of Deputies, where it is studied for two weeks. Finally, it moves to the Senate Budget Committee, where it is further revised for two weeks. The Senate can modify any item of the budget bill by simple majority, virtually drafting the "final" version of the budget (Molinas, J. R., & Pérez-Liñán, A, 2005).

In contrast to most countries in the region, in Paraguay the Congress exercises unlimited powers to revise and amend the budget bill submitted by the Executive. Even though the Fiscal Responsibility Law (FRL) and the Law of Financial Administration of the State (LFAS) contains important restrictions with respect to protecting fiscal sustainability in practice, the Executive budget proposal can be subject to substantial modifications and increases (Santos A., 2009). Not only can Congress increase capital expenditure but it can raise current expenditure allocations, including payroll and salaries (see Chapter 5). Congress also tends to justify these increases with upward revisions to revenue projections, which generally lack realism and credibility.

The role of Congress in the budgetary process, in particular the lack of tools and safeguards to ensure its adherence to fiscal objectives, impairs the soundness of the budget preparation process, compromises fiscal sustainability, and reduces the credibility of the budget document. This issue had special relevance in the last two budget formulation processes. In 2016, tensions between the two Branches of government escalated, culminating in an unprecedented presidential veto of the budget and the extension of the application of the 2016 fiscal year budget into 2017. Likewise, the president partially vetoed the budget law for 2018. However, on this occasion, the veto was overturned by absolute majority of both chambers of the Congress (Box 3.5), threatening the country's capacity to comply with the fiscal rule.

Box 3.5. Tensions between branches of government: 2017 and 2018 presidential vetoes to the Budget Law

In December 2016, the President vetoed the budget approved by Congress for the fiscal year 2017. The main reason behind the decision was to comply with the requirements of the Fiscal Responsibility Law and to avoid risks on Paraguay's ability to honour its debt obligations during 2017. Some of the modifications made by the Senate included restricting the amount of bonds the government could issue, raising public sector salaries (amounting to 0.2 percent of GDP),and imposing a cap on Central Bank instruments used for open-market operations and liquidity management.

In the absence of a congressional override of the Presidential veto, the 2016 Annual Budget, approved by Congress in 2015, was reinstated for 2017. In February 2017, the Budget Office of the Ministry of Finance published the Annual Financial Plan for 2017, adapting the Budget Law approved for 2016.

In December 2017, the 2018 budget Law was subject to a similar presidential veto. The main objective of this executive measure was to block salary increases in the health and education sector, and comply with the requirements of the Fiscal Responsibility Law. However, based on the powers granted in the Constitution, the two Congress Chambers overturned the decision with an absolute majority, forcing the president into the position of only being able to publish and enact the budget law.

Source: IMF (2017), Faruqee, H and David, A (2017)

Execution

The budget execution year matches the calendar year in Paraguay. According to the LFAS, the Ministry of Finance, in coordination with the OEEs, will propose to the President a monthly financial plan of revenue and expenditure for budget execution. The cash plan of the Central Government is based on the financial plan and subject to availability of resources of the General Treasury.

A particular feature of the budget process in Paraguay is that the Budget Law is not used by line ministers as the guiding document to program their expenditure. Within two months of the approval of the National Budget Law, the Ministry of Finance prepares and publishes the Annual Financial Plan, adjusting the ceilings included in the budget law approved by Congress to take into account revenues estimates and compliance with the Fiscal Rules (Box 3.6). Only when this plan is approved by the President by decree and published, the OEEs will know their definitive expenditure ceilings for the fiscal year. As a consequence, there seems to be an overlap between the budget execution phase and the budget formulation phase, at least during the first months of the year.

During the budget execution phase, OEEs can request budget reallocations to the Ministry of Finance. The rules and procedures for these reallocations are set in the annual budget law. As a general rule, budget supplements can only be authorised by law, budget reallocations between programmes from the same organisation should be authorised by decree, and budget reallocations within the same programme should be authorised by a dedicated ministerial resolution.

Box 3.6. Fiscal Rules in Paraguay

The Fiscal Responsibility Law (Law No. 5098/13) includes clear commitments to pursue a sound and sustainable fiscal policy in Paraguay. In particular, article 7 states that the annual budget laws are subject to the following fiscal rules:

1. The annual fiscal deficit of the Central Administration, including transfers, shall not exceed 1.5 percent of the estimated GDP for that fiscal year.

2. The annual increase in the primary current expenditure of the public sector shall not exceed the annual rate of inflation plus four percent. The primary current expenditure is defined as the total current expenditure excluding interest payments.

3. The Budget Law should not include salary increases unless there is an increase in the current minimum living wage. The increase shall be, at most, in the same proportion, and shall be included in the budget of the next fiscal year.

Likewise, the Law of Financial Administration of the State (Law 1535/99) states that public debt can only be used to finance productive investments, national emergencies, public administration reforms or refinancing public debt (Golden rule).

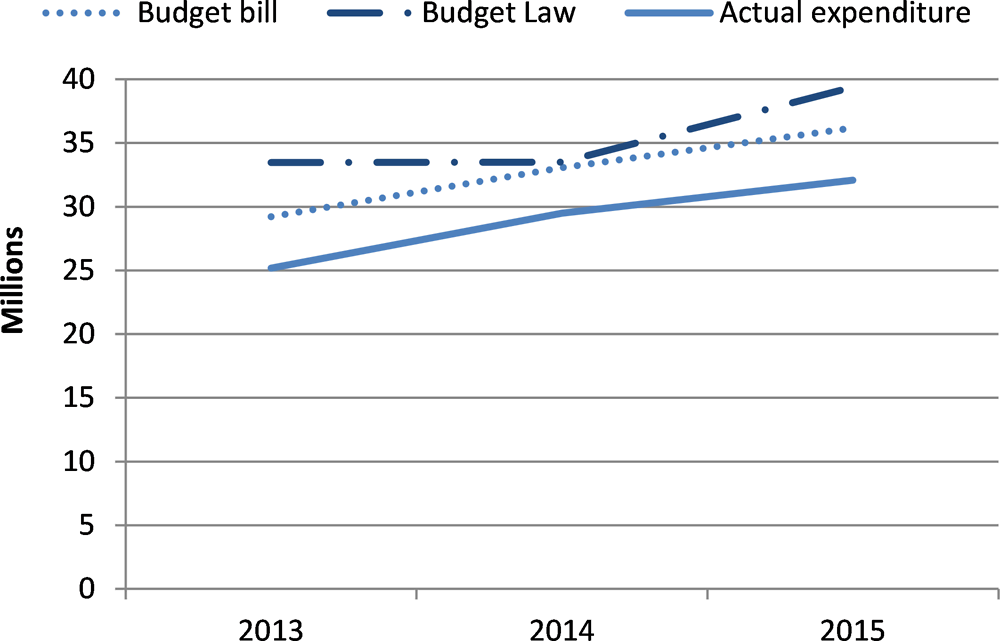

The particular characteristics of the Budget process in Paraguay lead to substantial differences between the initial budget bill prepared by the executive, the budget law approved by Congress, and actual expenditures (Figure 3.3).

Recent efforts to better align government strategic priorities with the budget

Strategic planning framework: National Development Plan Paraguay 2030

The first step towards aligning the budget with strategic government objectives is to have a well-developed and effective strategic planning framework. To be effective, national development plans must be costed, include indicators, targets and measurable goals and must provide a useful tool for line ministries to develop sectoral plans and thereafter annual plans. This layering of planning tools, in particular medium-term planning, is the backbone to establishing effective medium-term expenditure management. Medium-term expenditure estimates should be developed on the basis of the first level policy conceptualisation and prioritisation that has been developed in these plans, ensuring that budgets are carefully crafted.

As explained in detail in Chapters1 and 2, Paraguay has made important progress in strategic planning. The National Development Plan Paraguay 2030 is the strategic document that sets the country's strategic objectives and guides the actions taken by the Government. It is structured according to three strategic axes: 1) Reduction of Poverty and Social Development, 2) Inclusive Economic Growth, and 3) Insertion of Paraguay in the World; and four transversal lines: 1) Equality of Opportunities, 2) Transparent and Efficient Public Management, 3) Territorial Planning and Development, and 4) Environmental Sustainability. Based on these axes and strategic lines, the government developed 12 general strategies, each one composed with a set of specific objectives.

Paraguay has also made efforts to develop sectoral and institutional plans. One hundred twenty-one (121) Agencies and Entities of the State have an Institutional Strategic Plan (Planes Estratégicos Institucional PEI), which in most cases has a five-year term, and usually covers a presidential term. However, the level of development is not homogenous and these plans are not articulated or are only partially articulated with the PND. Furthermore, until now there is no structured process to coordinate the PND, the sectoral and the institutional plans with the medium term fiscal planning framework. There are some initial steps towards developing this practice at the subnational level. Starting in 2018, the Budget Law recommends municipalities and departments to have an institutional plan.

Reforming the budget structure towards programme budgeting

With the implementation of the National Development Plan 2030 the government of Paraguay has made remarkable efforts to restructure the budget document to strengthen the link with the Government's strategic objectives. Since 2014, the Government started implementing a "results-based planning system" (Sistema de Planificación por Resultados SPR), where results are placed upfront in the planning process and are the basis for defining the best combination of inputs, activities and productive processes that are needed to obtain these results.

The effective implementation of the Plan is carried out through the preparation of the Annual Institutional Operation Plans (Planes Operativos Institucionales POI), where each institution sets goals, the levels of responsibility and the resources that are needed to reach those goals. The POIs must consider the objectives of the PND as well as the actions, plans and projects developed to achieve extreme poverty reduction objectives.

Each OEE prepares its POI and budget based on the budget ceilings established by the Ministry of Finance. The POI is then uploaded into the Results-based Planning System of the STP, where all expenditures are linked with the objectives of the National Development Plan (NDP). The STP has developed not only the conceptual framework of the SPR but also guidelines for implementation, including guidelines to prepare and upload the POI.

Currently, the 12 strategies of the National Development Plan are considered as budget programmes related to or linked with the National Development Plan, which provides an estimate of the allocation of resources assigned to each strategy. This new structure has helped reduce the number of budgetary programmes while improving their clarity, and has provided a clearer understanding of their links to and coherence with the NDP. For example, several entities had a programme to support the indigenous population. Under the new system these programmes were clustered under a common objective. Likewise, the new structure of the budget increases flexibility in the budget process by defining budget lines at a more aggregated level.

The data loading process to the SPR starts in the beginning of May and is to be finished by the end of May. On the first days of June the information is then transferred into the Integrated Financial Management System (Sistema Integrado de Administración Financiera SIAF) in order to articulate the budget information with treasury, accounting, credit and public debt systems. This process is to be finalised by the end of June. The Ministry of Finance is restructuring the SIAF in order to have a more comprehensive Information System that articulates planning, budgeting and execution.

There has been considerable progress, in a short time, in setting out a comprehensive framework and clear guidelines to develop the programme structure, with clarifications and definitions of key terms and concepts. In this process, the STP joined efforts with the Ministry of Finance to provide line ministries with training and guidelines on how to link their budget with the NDP. The STP has also worked closely with the technical office of the Bicameral Budget Commission of the Congress. Despite the initial difficulties to adapt to the new structure most OEEs recognise the benefits of the new system in terms of simplification, flexibility and alignment with the strategic objectives.

Despite these notable improvements, there is still space to improve the programme budgeting reform. Although there is a relation between the objectives or annual results (IOP) and the annual budget, in the medium term there is no relation between objectives and the financial allocation that would be assigned to them. As will be explained in further detail in the next section, the medium term expenditure framework does not take into account targets or medium-term objectives identified in the National Development Plan.

Performance Budgeting

One of the most challenging elements of budgetary governance is ensuring that public funds, once they have been allocated and spent, can be subject to ongoing monitoring and evaluation to ensure that value-for-money is being attained (Box 3.7). Performance budgeting is a critical tool to improve the link between the Government's strategic objectives and the annual and multiannual budget process. The Government's strategic objectives should be monitored and evaluated so that the Government and society as a whole can see the improvements achieved and implement corrective measures when needed.

Programme monitoring and evaluation (M&E) is an essential tool for the assessment and improvement of policies, and for the reallocation of resources to where they can achieve the greatest impact. The monitoring dimension of M&E involves using data generated during programme execution to ensure compliance with budgetary restrictions and to assess achievement of objectives. Systematic evaluation of programmes uses standardised, professional methodologies to allow a broader re-assessment of the policy rationale for a programme's continued existence, in light of other modalities and competing policy priorities, and to ensure that lessons learned can be integrated in policy revision.

As explained in chapter 2, the monitoring and evaluation framework is not well defined in Paraguay. Both the Ministry of Finance and the STP have developed interesting initiatives to measure performance (i.e. performance informed framework and SPR). However, responsibilities are not clearly defined and coordination mechanisms are lacking. Furthermore, the new Council mandated by the PND to evaluate performance of public programs and institutions has not yet been created (see next section).

Box 3.7. Key challenges in implementing programme budgeting in OECD countries

Some common challenges in implementing programme and performance budgeting in OECD countries, regardless of approach, concern the use of performance information, which is at the most advanced stage of implementing a performance informed budgeting system. These challenges include improving measurement of performance, finding appropriate ways to integrate performance information into the budget process, gaining the attention of key decision makers, and improving the quality of the performance information. Although there are exceptions, most governments have found it difficult to provide decision makers with good quality, credible and relevant information in a timely manner, as well as providing incentives for stakeholders to use this information in budgetary decision making. Some OECD countries have faced some level of resistance from public servants to changing practices, as well as difficulties in developing the institutional capacity of the Ministry of Finance and line Ministries in using performance information

As one of the first countries to implement programme budgeting, Australia's approach to incorporating a focus on performance has been a long-term, iterative process. This has provided many benefits, not least the opportunity to learn from experience before proceeding with further reforms. This has also been important because of the interrelationship between performance and other aspects of the financial, accountability, political and management environment. The complexity of interactions and incentives is difficult to comprehend in isolation from practical experience, making "big bang" changes potentially high risk. Two recurring themes in establishing good performance information that Australia has faced are:

-

The quality of performance information in relation to agency contributions to outcomes and outputs.

-

The limited use of the performance information for decision making in the budget context.

With respect to outcomes and outputs, it is important to ensure that links between programmes, outputs and outcomes are clear and measured effectively, particularly if this performance information is to be relied on for budget decision making. It is crucial that new policies and practices are well understood by people in line agencies and that they have the skills, capacity, resources and authority to implement the initiatives effectively. With respect to enhancing the utility of performance information for budget decision-making, a major challenge in introducing a systematic approach to programme reviews has been to ensure that it adds value to government considerations, uses agency resources efficiently, and does not become a mechanical exercise.

Source: Performance Budgeting in OECD Countries, OECD (2007)

Performance informed framework

Paraguay started using performance information in 2004, but it was only in 2011 that the Government started laying the ground for a more comprehensive performance framework. According to the Resolution of the Ministry of Finance No. 287 from 2011, the Government is to implement performance-based budgeting as a tool that creates an indirect but systematic link between performance information and resource allocation between public institutions and priorities. The Ministry of Finance exercises the role of control, monitoring and evaluation of the information submitted by the Agencies and Entities of the State under the performance informed framework.

Currently, there are three main tools implemented under the performance-based budgeting (Presupuesto por resultados) framework (Ministry of Finance of Paraguay, 2016). However, these tools are not yet articulated with the NDP or the SPR reform.

-

Performance indicators. These indicators provide qualitative and quantitative information related to outcomes on goods and service provision. In 2015, there were 166 performance indicators applied against 57 programs, subprograms and projects from the central administration.

-

Public Management Annual Reviews (Balances Anuales de Gestión Pública BAGP). The BACPs are annual reviews where OEEs report the progress achieved during the fiscal year, in terms of objectives, goals and results, and set the institutional commitments for the next fiscal year. These documents are presented to Congress and are available on the webpage of each institution.

-

Public programme evaluation. This is a form of ex-post evaluation report on the evolution of public programmes, comparing the achieved results with the initial objectives. There have been 26 public programmes/sub-programmes evaluated in the past 5 years.

Results based planning system (SPR)

The SPR reform helps OEEs to set their expected results and establish indicators to monitor progress at the institutional level; however, there is no overarching framework for evaluating and monitoring the implementation of the plan. The PND foresees the creation of a National Council for Public Management Evaluation. This new Council should evaluate performance of public programmes and institutions. In particular, it should establish a biannual agenda prioritising institutions and programme evaluations as well as setting responsibilities and resources to carry out these evaluations. Despite the vital importance of this institution for the implementation of the SPR reform, the council has not yet been created.

The Technical Secretariat for Planning has developed an institutional tool for planning, managing, monitoring and evaluating the achievement of institutional goals aligned with the national development plan. The implementation of this monitoring tool has been gradual. OEEs that have social-policy outputs prioritised within the framework of the Government's Sowing Opportunities Program (Programa Sembrando Oportunidades– a major social-policy programme) started reporting progress on the institutional outcomes in 2015. These results are published on a citizen's oversight dashboard, with detailed information on progress achieved. In 2017, all OEEs will start reporting the monthly progress of goals established in the IOP.

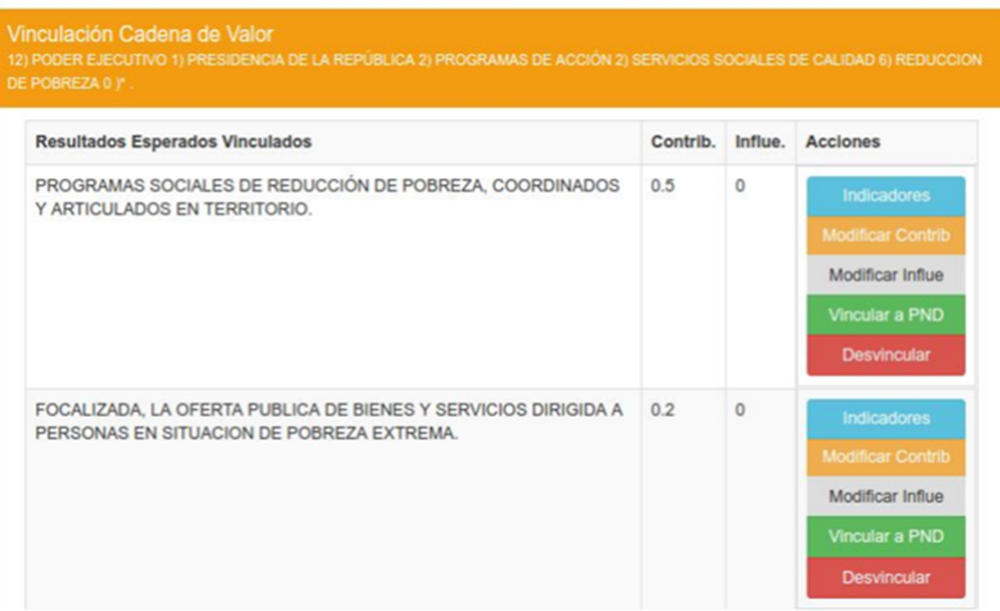

Under the SPR reform, OEEs are to set one or more expected results from each one of the programmes, sub-programmes and projects defined in the Annual Institutional Operation Plans. These results are to be attached to the PND (Figure 3.4). Each result is then supposed to be linked to an indicator and a target for the following 3 years (Figure 3.5). Indicators are selected from an indicator catalogue (OEEs are free to add indicators to the catalogue).

By 2017, all OEEs are to prepare the POI based on this framework. However, the quality of the indicators and the targets set varies across institutions. Despite improvements, in practice, it appears that there is still progress to be made in ensuring that these concepts are correctly and uniformly understood across all line ministries and agencies.

Selecting and using performance indicators to monitor and measure progress in achieving targets are among the most challenging dimensions of a programme budgeting reform. However, when the correct set of indicators is in place, this can help to leverage the performance system as a catalyst for progress in other dimensions of public policy (Box 3.8).

Box 3.8. Key performance indicators and public policy

Austria has over recent years reformed and streamlined its budgetary framework so that each ministry presents its estimate on a programme basis, with a small number (no more than 3-5) of performance objectives specified for each programme. At least one of these programmes must relate to gender equality. Both the resources allocated to each programme, and the performance relative to the objectives, are subject to audit by the supreme audit institution.

Example of indicators: Number of men and women who attend preventive health examination; percentage of women between 45 and 75 years who participate in breast cancer screening.

Likewise, New Zealand has a well-developed results approach, whereby agencies are organised around the outcomes that matter to citizens, and in this context each agency must specify the "vital few" indicators that will tell whether these goals are being achieved.

Example of indicator: Percentage of children sitting and achieving School Certificate in five subjects.

The United States has also placed a high priority on articulating clear performance objectives for each agency, including a small number of "agency priority goals"; these objectives have become an organising principle for public accountability and also for internal management and staff engagement.

Scotland's National Performance Framework involves a co-ordination mechanism to ensure alignment of strategies and programmes across sectors, in support of broader national outcomes.

Example of indicators: Proportion of driver journeys delayed due to traffic congestion; Total additions to the supply of housing, including public and private new house building; conversions of existing buildings to housing use; and refurbishment of dwellings.

Source: OECD, The Governance of Inclusive Growth, 2015

Medium term expenditure framework

Developing a stronger medium-term dimension in the budgeting process (beyond the traditional annual cycle) is a key element to ensure that budgets are closely aligned with the medium-term strategic priorities of government. Medium-term expenditure frameworks (MTEFs) strengthen the ability of the Government in general, and the Ministry of Finance in particular, to plan and enforce a sustainable fiscal path. If properly designed, a MTEF should force stakeholders to deal with the medium term perspective of budgeting and budgetary policies rather than adopt an exclusively year-by-year approach.

Paraguay presents some of the basic foundations of medium-term budgeting. In particular, the Fiscal Responsibility Law (2013) provides a multi-annual perspective to the budget process. Since 2014 Paraguay's annual budget has to be framed within a multi-annual fiscal scenario (Law 5098 of 2013). The Macro-fiscal Policy Direction of the Ministry of Finance develops medium-term fiscal projections based on nominal GDP, expected inflation, real GDP growth, the exchange rate, and import levels. These projections are included in the public finance report (Reporte de Finanzas Públicas) and included in the annual budget documentation presented to the Congress.

The Multiannual Financial Programming system has a three-year perspective, with estimates for the current year and for two outer years included as annexes in the annual budget documentation. Based on the multiannual macro-economic projections, the Ministry of Finance establishes multiannual indicative expenditure ceilings. These ceilings are defined centrally and communicated to all public institutions the 1 of July. Based on these ceilings, public institutions estimate their medium-term expenditures for the budget year and the following two years. These ceilings are only used as reference. In practice, budget allocations are redefined during the annual budget formulation process.

Box 3.9. Levels of development of medium-term budgeting

As for other reforms, there are several levels at which medium-term budgeting can be undertaken. According to a typology developed by the World Bank, at a first level a Medium Term Fiscal Framework (MTFF) contains a statement of fiscal policy objectives and a set of integrated medium-term macroeconomic and fiscal targets and projections. A Medium Term Budget Framework (MTBF) builds on an MTFF by developing medium term budget estimates for individual spending agencies. The objective of an MTBF is to allocate resources to strategic priorities and ensure that allocations are consistent with overall fiscal objectives. The advantage of this approach is to provide some degree of budget predictability to spending agencies, while safeguarding overall fiscal discipline. A Medium Term Expenditure Framework (MTEF) then adds further detail to this approach by providing additional elements of activity and output based budgeting. These additions aim to further enhance an emphasis on value for money of public expenditure, in addition to reinforcing fiscal discipline and strategic prioritisation.

Source: World Bank, 2013

Despite recent improvements, the medium term expenditure framework is still at an embryonic stage of development (Box 3.9). In Paraguay, multi-annual expenditure ceilings are only used as a reference in the budget document. In practice, they are redefined each year by the Ministry of Finance during the annual programing phase. The differences on the estimates are not studied in the public finance report and there is little analysis on the reasons behind these variations.

The impact of a medium-term perspective on the budget depends ultimately on the credibility of the expenditure estimates and ceilings as well as how this information is used by decision-makers and members of civil society. Failure to achieve medium-term budget objectives is often related to weak arrangements surrounding the preparation, legislation and implementation of budgetary targets.

The recently-created fiscal council could have a strategic role in improving the multi-year projections of revenues and expenditure in Paraguay, increasing credibility of these estimates (Box 3.10).

A second consideration is that the Multiannual Financial Programming exercise in Paraguay does not take into account targets or medium term objectives linked to the long term strategic plan. Although there is a relation between the objectives or annual results and the annual budget, in the medium term there is no relation between objectives and the financial allocation that would be assigned to them. Expenditures are projected based on a comparative percentage increase, without a clear link with the Institutional Strategic Plans or the National Development Plan.

In countries with effective medium-term budgeting, medium- term projections of budget programmes are based on existing spending policies, together with the impact of proposed new budget policies, which are clearly linked to annual budgets, all on a programme-basis. However, in the case of Paraguay, the government does not produce expenditure estimates for medium term programs and investments; expenditure priorities are studied only for the current budget year. In addition, the system used to program the annual budget (SPR) is dissociated from the multiannual framework programing exercise.

The credibility of the medium term expenditure framework is also challenged by the unlimited powers exercised by Congress during the budget approval phase, introducing substantive amendments in the budget bill submitted by the Executive, compromising fiscal sustainability, and reducing the credibility of the multiyear expenditure estimates.

Box 3.10. The recently created Fiscal Advisory Council

The Fiscal Advisory Council (Consejo Fiscal Asesor, CFA) was created by the Decree 6498 of 2016 as an independent body that will contribute to the discussion, analysis and issuance of opinions regarding fiscal policy. The CFA will offer opinions regarding the variables upon which the budget policy is created, helping in the dissemination of knowledge about the status of public finances, and guiding discussions on fiscal policy.

In particular, the functions of the CFA are:

-

To issue an opinion regarding the fiscal result calculated by the Ministry of Finance in the Budget bill. This includes the issuance of an opinion regarding the macroeconomic projections of revenues and of fiscal expenditures.

-

To issue an opinion regarding the fiscal and macroeconomic implications of the changes made by the Legislative Branch to the Budget bill submitted by the National Government.

-

To express its opinion and to make recommendations to the Ministry of Finance on possible changes related to fiscal targets and public finances.

-

To advise the Ministry of Finance in fiscal matters.

The council is composed of three members nominated by the Minister of Finance. The members should come from the private sector or the academia and are nominated for a three-year period, which can be extended. Although the CFA has no permanent staff, the decree provides for administrative and technical support from the Macro-fiscal Department of the Minister of Finance, which has qualified personnel to respond to the council's needs.

Recommendations

Based on the preceding assessment, to enhance the strategic links between strategic planning and the budget-setting and execution process, Paraguay could consider the following:

-

Increase transparency by informing citizens about the budget law, the differences with the budget bill presented by the Executive, the financial plan and actual expenditures

Budget transparency means being fully open with people about how public money is raised and used. Clarity about the use of public funds is necessary so that public representatives and officials can be accountable for effectiveness and efficiency. Likewise an open and transparent budget process fosters trust in society that people's views and interests are respected and that public money is used well. Furthermore, transparency supports better fiscal outcomes and more responsive, impactful and equitable public policies.

Given the particularities of the Paraguayan budget process, it is essential that citizens access not only the full budget documentation and underlying economic analysis, but information about the amendments introduced during the legislative debate, the financial plan, and the scale and justification of the differences between these instruments. This approach will promote accountability and, through presenting the budget materials (including performance information) in a regular and clear manner, will underline the link between the resources available and the targets to be achieved. Furthermore, if well informed, citizens can play a key role in holding Congress accountable for the quality of amendments introduced during the budget approval phase. The newly created CFA could also play a key role in supporting the implementation of this recommendation.

-

Promote a sustained, responsible engagement of Congress during the full cycle of the budget process

The government could consider regular updates to revenue and expenditure projections and debates on fiscal objectives in order to engage the Congress in positive ways, and to build alliances for responsible engagement on budgetary development. For example, the Executive could commit to implement revenue and expenditure projections updates before the closure of the first semester of the year, aiming to inform Congress about the economy and ensure these aspects are taken into account during the budget formulation and approval phase for the next budget year. Furthermore, the Executive could present the Fiscal Framework and the priorities of the budget to the Congress previous to the presentation of the budget bill.

-

Link the national plan with institutional and sectoral plans (and the decentralisation framework – see chapter 4 recommendations below)

To be effective, national development plans must be costed, include indicators, targets and measurable goals and must provide a useful tool for line ministries to develop sectoral plans and thereafter annual plans.

Even though Paraguay has made efforts to develop sectoral and institutional plans, these plans are not fully articulated with the PND and the level of development is not homogenous. Paraguay could greatly benefit from developing a structured process to coordinate the PND, the sectoral and the institutional plans with the medium term fiscal planning framework.

-

Consolidate the "Results-Based Planning System" reform by strengthening the performance budgeting framework

The government of Paraguay has made remarkable efforts to restructure the budget document towards strengthening the link with the Government's strategic objectives. However, there is still space to improve the programme budgeting reform. In particular, the government could consider:

-

-

Embedding the reform in a more robust instrument to ensure stability and continuation;

-

Establishing a mechanism that allows the government to design and formulate budgetary programs in order to better link them with the institutional, sectoral and national results, defining an overarching framework for evaluating and monitoring the implementation of the plan;

-

Clearly defining responsibilities for evaluation and monitoring and articulate the current performance frameworks (i.e. performance informed framework and SPR);

-

Strengthening the link with key high level objectives (e.g. KNIs and SDGs). This will help anchor and orient the performance budgeting framework;

-

Developing a medium-term plan to articulate the SPR with the medium-term expenditure framework (MTEF) and the budget programs at the subnational government level.

-

-

Strengthen the Medium-Term Expenditure Framework

The multi-year projections of revenues and expenditure should evolve from technical extrapolations to realistic forecasts, based on information and realistic assumptions about the consequences and costs of current policy (taking into account the development of demand) and of alternative proposed policies. In particular, Paraguay could consider the following recommendations:

-

-

The ceilings for total expenditures and ministerial envelopes should apply to the medium term;

-

The Multiannual Financial Programming exercise should take into account targets and medium term objectives linked to the long term strategic plan;

-

The ceilings for total expenditures and the ministerial envelopes should be based on a trade-off / reconciliation of medium-term sectoral plans and revenue options;

-

Consider implementing carry-over mechanisms which allows for programmes that have incurred delays to be moved over to the following year within certain conditions;

-

Align existing medium-term sectoral plans with medium term estimates.

-

-

Make full use of the newly created Fiscal Advisory Council (FAC) to strengthen revenue projection estimates

Revenues should be estimated as precisely as possible from the outset of the annual process. Furthermore, the economic projections and underlying assumptions should be made public, so that they can command public and political confidence as the standard official basis for decision making about expenditure and tax policy developments. This will not only increase predictability and transparency in the budget process, but will strengthen the bases of the budget process preparation, helping to inform and guide the engagement of the Congress during the budget cycle.

As in the case of several OECD countries, having an independent technical body in charge of the economic assumptions for revenue forecasting can support the quality, credibility and transparency of revenue estimates (Box 3.11).

Box 3.11. The Spanish Independent Authority for Fiscal Responsibility and its impact in revenue projection

The Spanish Independent Authority for Fiscal Responsibility (AIReF) was established in 2013 as part of a national reform process with the aim of reinforcing the Spanish fiscal framework, meeting new European obligations, and restoring Spain's public finances and setting them on a sustainable path. AIReF has a broad mandate to ensure effective compliance with Spain's constitutional budgetary stability principle by public administrations at all levels of government. This includes continuous monitoring of the budgetary cycle and public indebtedness, as well as analysis of government economic forecasts.

According to a recent study carried out by the OECD, AIReF has made a positive contribution to improved fiscal management in Spain at all stages of the fiscal policy cycle. At the planning stage, it is widely believed that AIReF has helped generate improvements in forecast methods. Those stakeholders working on national forecasts welcomed the richer technical discussions that were now possible with the addition of AIReF in this area. Stakeholders also observed that while AIReF initially gave the opinion that revenues were overestimated in relation to both the macroeconomic forecast and the pension revaluation index, there has since been a convergence between the government's forecasts and AIReF's opinion. This suggests that AIReF's oversight has been instrumental in making the government more prudent, although there are likely to be other factors at play such as improved economic conditions. AIReF has also improved forecasting methods at the regional level, for example, through setting up a working group up to ensure that all regions have access to robust tools to project regional GDP and employment.

Source: OECD, 2017

In Paraguay the CFA was created at the initiative of the Ministry of Finance and authorized by Decree. Newly created, it is still at a very early stage of development. However, given its mandate and overall functional objectives, it has the potential to play a major role in strengthening revenue projections. Official projections should be closely scrutinised and, where appropriate, revised by this institution. In the longer term, it may be advisable for the CFA to adopt a more substantive role in this regard, in keeping with trends in OECD countries.

In order to fully achieve this objective, Paraguay should consider applying the OECD Recommendation of the Council on Principles for Independent Fiscal Institutions (e.g. protect the IFI non-partisanship and independence status and ensure that its mandate is aligned with the resources allocated to the institution). A detailed analysis on how to better align the current institutional framework with the OECD recommendations could be included in an OECD review solely focused on Budgetary Governance.

-

Consolidate other inter-connected and mutually supportive elements of budgetary governance

Implementing a realistic, credible national planning and budgeting framework requires progress across many dimensions of budgetary governance, such us: budget flexibility, effective budget execution, inclusive, participative and realistic debate on budgetary choices; transparency, openness and accessibility of budget documents; citizen engagement; identification and management of fiscal risks; and budgeting within fiscal objectives. Given the extent and complexity if these topics, Paraguay will greatly benefit from having an OECD review solely focused on Budgetary Governance.

References

European Commission and OECD (2012), OECD Economic Surveys: Euro Area 2012, OECD Publishing.

IMF (2017), Paraguay 2017 Article IV Consultation—Press Release and Staff Report, Country Report No. 17/233

Faruqee, H and David, A (2017), Why 2018 Is a Pivotal Year for Paraguay, http://www.imf.org/external/np/blog/dialogo/120517.pdf

Kraan, Dirk-Jan (2008), Programme budgeting in OECD countries, in OECD Journal on Budgeting, volume 7, no. 4, OECD Publishing, Paris.

Ministry of Finance of Paraguay (2016), Budgeting for Results Progress 2015, http://www.hacienda.gov.py/web-presupuesto/index.php?c=264

Molinas, J. R., & Pérez-Liñán, A. (2005). Who Decides on Public Expenditures?: A Political Economy Analysis of the Budget Process in Paraguay. Inter-American Development Bank.

OECD (2007), Performance budgeting in OECD countries, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264034051-en

OECD (2013), Colombia: Implementing Good Governance, OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264202177-en

OECD (2014), Budgeting Practices and Procedures in OECD Countries, OECD Publishing, Paris http://dx.doi.org/10.1787/9789264059696-en

OECD (2015), Recommendation of the Council on Budgetary Governance, OECD Publishing, Paris, http://oe.dc/UA

Von Trapp and others (2017), Review of the Independent Authority for Fiscal Responsibility (AIReF), https://www.oecd.org/gov/budgeting/airef-review-en.pdf

Ronnie Downes, Delphine Moretti and Scherie Nicol (2017), "Budgeting and performance in the European Union: A review by the OECD in the context of EU budget focused on results", OECD Journal on Budgeting. http://dx.doi.org/10.1787/budget-17-5jfnx7fj38r2

Santos, A. (2009). Paraguay: Addressing the Stagnation and Instability Trap. International Monetary Fund.

STP (2017) Instructivo para la elaboración del plan operativo institucional. https://www.google.fr/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0ahUKEwjghbS71cPXAhVEC8AKHS0wCmEQFggsMAE&url=http%3A%2F%2Fwww.stp.gov.py%2Fv1%2Fwp-content%2Fuploads%2F2017%2F04%2FInstructivo-para-elaboraci%25C3%25B3n-del-Plan-Operativo-Institucional-2018-2020.pdf&usg=AOvVaw2UimTjitcO9bAtIWaFBjiD

World Bank (2013), Beyond the annual budget, Global experience with Medium-term expenditure frameworks

Source: https://www.oecd-ilibrary.org/sites/9789264301856-6-en/index.html?itemId=%2Fcontent%2Fcomponent%2F9789264301856-6-en

0 Response to "Short Term Budgeting Continues to Reinforce Long term Policy Decisions"

Publicar un comentario